地址 : 台北市大安區復興南路一段380號12樓

電話:(02) 2704-0020

傳真:(02) 2704-0310 / (02) 2704-8040

誠一協助南韓遊戲廠商申請適用台韓租稅協定,獲得營業利潤免稅優惠之適用

誠一協助南韓遊戲廠商申請適用台韓租稅協定

獲得營業利潤免稅優惠之適用

許多公司常遺漏了上述租稅協定帶來的優惠,相當可惜。在113年1月1日起開始生效的台韓『避免所得稅雙重課稅及防杜逃稅協定(簡稱台韓所得稅協定)』,就讓誠一的一家遊戲廠商客戶,從原本以跨境電商身分申請營業利潤及境內貢獻度核定的狀況下(實質扣繳稅率已由原本的20%大幅下降至1.6%),進而免除所有的扣繳稅負。在許多外商不願意多支付台灣國稅局所徵收的扣繳稅負情況下,申請適用租稅協定,就等於間接幫台灣公司節省了50%的扣繳稅負及增加50%的現金流入。

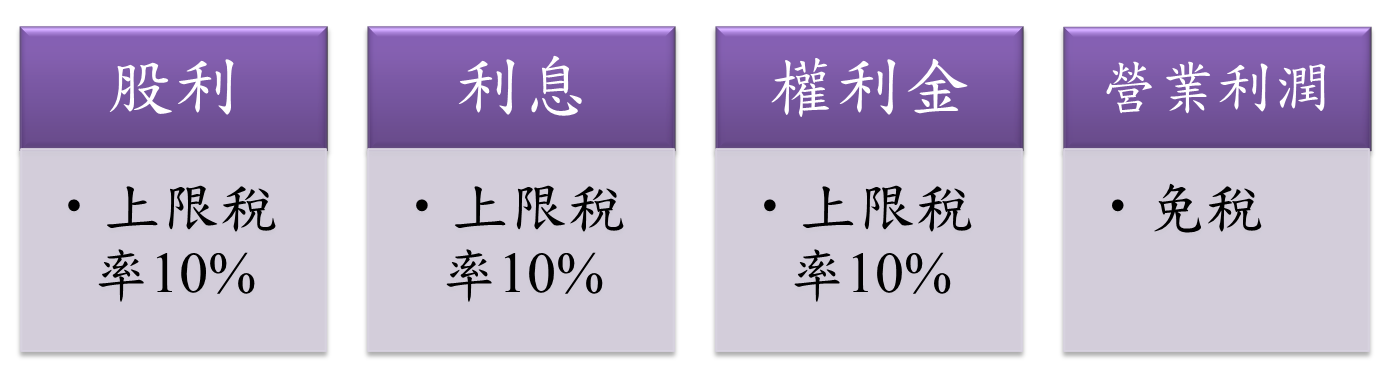

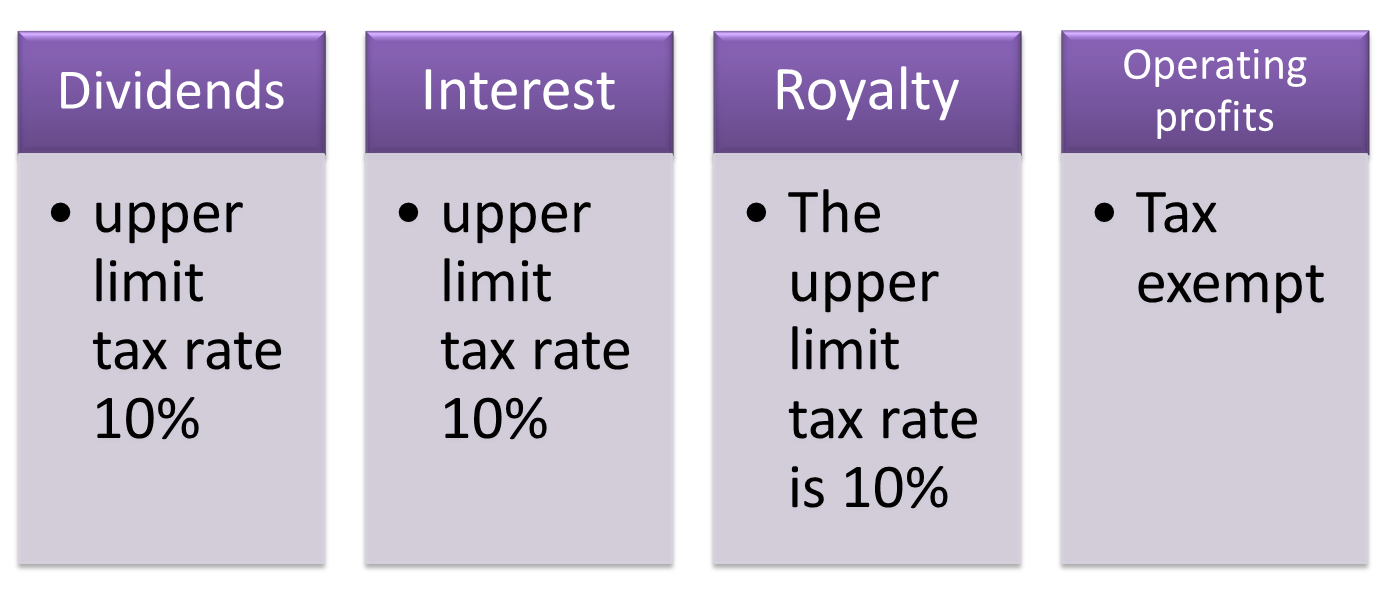

許多韓國廠商來台投資設立子公司取得股利、提供關係企業營運資金取得利息,以及授權使用專門技術取得權利金。在台韓所得稅協定生效適用前,台灣公司給付前述各類所得時,應依我國國內法規定稅率扣繳(股利21%、利息及權利金20%),但台韓所得稅協定生效後,只要是符合所得稅協定規定的股利、利息或權利金所得,僅須備妥南韓公司的南韓稅務居住者證明,得按協定上限稅率10%扣繳,不須再進行額外申請。

另外,韓商若因派遣員工來台提供服務或跨境銷售電子勞務而取得我國來源所得,如果符合協定的營業利潤條文規定,得申請核准減免所得稅。跨境的投資架構也可再次檢視,以消弭重複課稅的風險,並增加集團整體運作之稅率性。

如果需要進一步諮詢,歡迎與林必佳會計師聯繫 (karin@chainye.com)

Chainye assists South Korean game company to apply for the Taiwan-Korea Tax Treaty and obtain the approval of tax exemption on operating profits

Many companies often miss out on the benefits brought by the above-mentioned tax treaties, which is a pity. The Taiwan-Korea Tax Agreement on the Avoidance of Double Taxation and Prevention of Tax Evasion in Income Taxes (referred to as the Taiwan-Korea Income Tax Treaty), which came into effect on January 1, 2024, has allowed a game industry client of Chainye to eliminate its Taiwan withholding tax burden from a cross-border e-commerce applicant with deemed business profit and domestic contribution (the actual withholding tax rate had been significantly reduced from the original 20% to 1.6%) to a tax treaty applicant, which all withholding tax burdens will be exempted. In a situation where many foreign companies are unwilling to pay more of the withholding tax levied by the Taiwan Internal Revenue Service, applying for a tax treaty will indirectly help Taiwanese companies save 50% of the withholding tax and increase cash inflow by 50%.

Many Korean companies come to Taiwan to invest and establish subsidiaries to obtain dividends, provide working capital for related parties to obtain interest, and authorize the use of specialized technologies to obtain royalties. Before the Taiwan-Korea Income Tax Treaty comes into effect, when Taiwanese companies pay the aforementioned types of income, they should withhold it at the tax rates stipulated in Taiwanese domestic laws (dividends 21%, interest and royalties 20%). However, after the Taiwan-Korea Income Tax Treaty comes into effect, as long as it is Dividends, interest or royalties that comply with the provisions of the income tax agreement only need to prepare the South Korean tax resident certificate of the South Korean company, and can be withheld at the upper limit tax rate of 10% in the agreement with no additional application required.

In addition, if Korean companies obtain income from Taiwan by sending employees to Taiwan to provide services or cross-border sales of electronic services, they may apply for approval for income tax reduction or exemption if they meet the operating profit provisions of the agreement. Cross-border investment structures can also be reviewed again to eliminate the risk of double taxation and increase the tax flexibility of the group's overall operations.

We are welcomed to provide our consultation service to you and your company.

Please contact CPA Karin Lin at karin@chainye.com.

聯絡我們

地址 : 台北市大安區復興南路一段380號12樓

電話:(02) 2704-0020

傳真:(02) 2704-0310 / (02) 2704-8040

E-mail:wendy@chainye.com

網站連結

誠一專業服務 法律 會計 稅務© All rights reserved

By anyway

我們使用cookie來確保我們在您的網站上給您最好的體驗。 要了解更多訊息,請轉到“ 隱私權政策” 頁面。